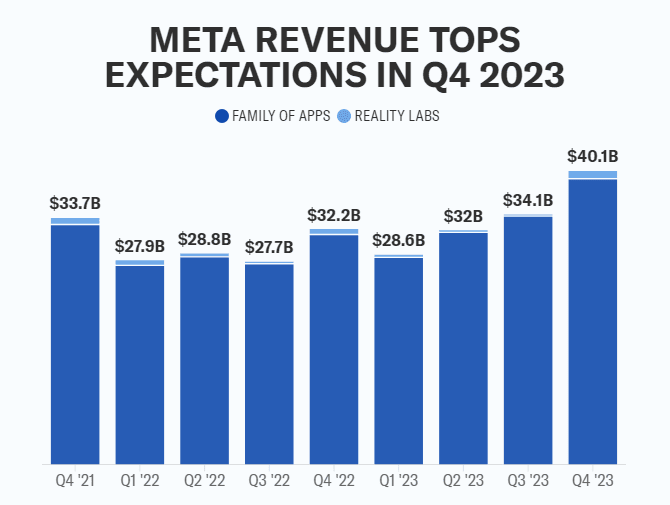

The Meta is considered as giant company as everyone knows about it. It makes money by putting ads on people who use its apps and websites. On Friday, the company reported its fourth quarter and full year 2023 results, which exceeded analysts’ expectations. The company also announced that it would initiate a quarterly dividend of $0.50 per share, starting from the first quarter of 2024, to reward its shareholders.

This news sent the stock price of one of the world’s most valuable companies soaring by 12%, reaching a new all-time high of $1,234.56. This was a positive development for the company, which has been investing heavily in its vision of building the metaverse, a digital realm where people can do anything they want.

There are a lot of users who check Meta Platforms’ apps every day. Advertisements were shown to them in greater quantities than usual, and they were charged a higher price for them. In addition, it is a division of the company that is primarily concerned with the development of virtual worlds that individuals can access by donning specialized eyecare. However, that particular division of the company is experiencing a significant loss of money and is confronted with a great deal of competition from other companies, such as Apple.

The goal of Meta Platforms is to make artificial intelligence (AI) that can learn and think like a human. It guarantees to make this artificial intelligence accessible to all. But it will take a lot of time and money to make this artificial intelligence, and it is not an easy task to accomplish.

Meta Platforms’ chief executive officer Mark Zuckerberg attended a gathering last September in Meta headquarters in Menlo Park where he shared his expectations for the company. He has expressed a desire to create the metaverse, a virtual world in which individuals are free to participate in any activity they choose.

The company that was formerly known as Facebook, Meta, is going to spend a considerable amount of money this year to staff its efforts and hire extra personnel. On top of that, it needed to spend a considerable amount of money to close some of its offices and let go of some of its staff during the previous year. It is currently operating with a reduced workforce in comparison to what it was in the past.

Over the previous year, it has had a rich and abundant amount of success. Over the last several years, the stock price of the corporation has increased by more than twofold, and its current value accounts for more than one trillion dollars. However, the performance of other big corporations like Apple, Google, Microsoft, and Amazon is substantially poorer than its own. This is the case.