The demand for GPUs has surged in the past year, driven by the rise of artificial intelligence (AI) applications. This has attracted many investors to chipmakers, especially Nvidia, which has seen its shares soar 200% year over year. But Nvidia is not the only player in the game. AMD (NASDAQ: AMD) is also making big moves in the AI and PC markets, and it could have more upside potential than its rival.

Nvidia reached a milestone in 2023, becoming the first chipmaker to cross a market cap of $1 trillion. Advanced Micro Devices (AMD) is still far behind, with a market cap of $286 billion. But this also means that AMD has more room to grow, especially as it challenges Nvidia with its new AI GPU and leverages the recovery of the PC market. AMD’s shares have already risen 123% year over year, but they are not done yet.

Grabbing a bigger share of a $200 billion opportunity

The AI market is booming, reaching nearly $200 billion in 2023, according to Grand View Research. The market is expected to grow at a staggering 37% compound annual growth rate until 2030, surpassing $1 trillion by then. It’s no wonder that tech companies like AMD are investing heavily in this emerging sector.

AMD launched its latest and most powerful GPU, the MI300X, in December 2023. The new chip is designed to compete head-on with Nvidia’s H100 AI GPU. AMD claims that the MI300X matches Nvidia’s performance for training and beats it by 10% to 20% for inference.

But AMD doesn’t need to topple Nvidia to benefit from the AI market. Nvidia could still maintain a dominant position in AI GPUs, while AMD could carve out a profitable niche in the sector. And AMD already has some impressive customers for its new GPU.

Microsoft announced in November 2023 that Azure would be the first cloud platform to use AMD’s new GPU to enhance its AI capabilities. Microsoft has a close partnership with OpenAI, one of the leading AI research organizations. This makes Microsoft a valuable partner for AMD. AMD also secured a deal with Meta Platforms, formerly known as Facebook, to use its new chips as well. These deals show that AMD has a bright future in AI.

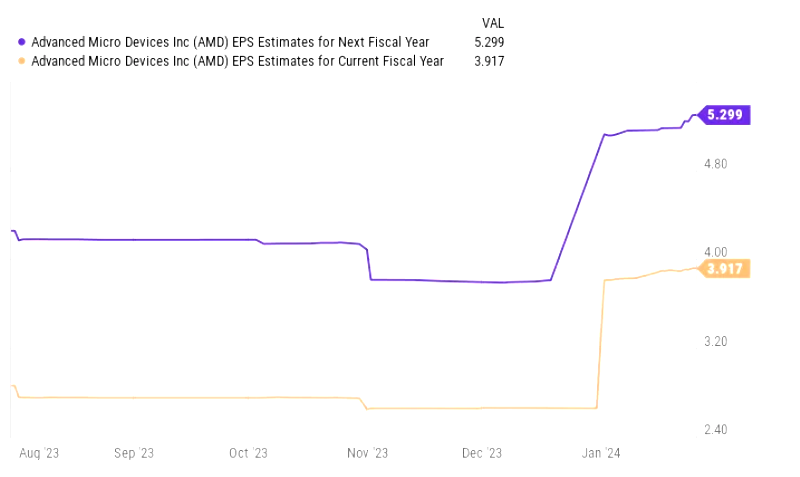

Earnings-per-share (EPS) estimates indicate huge potential for AMD’s stock. AI is not the only market that AMD is benefiting from. AMD is also enjoying the recovery of the PC market, which has been hit by macroeconomic challenges in the past year. Data from Gartner shows that global PC shipments increased 0.3% in the fourth quarter of 2023, the first increase in over a year. The PC market is expected to continue improving in 2024.

AMD’s earnings reflect the improvement of the PC market. In its Q3 2023, AMD’s revenue in its client segment rose 42% year over year to $1.4 billion. With the combination of AI and PC markets, AMD could have a stellar growth year in 2024.

EPS estimates support AMD’s growth potential, with its stock projected to soar in its next fiscal year.

If the estimates are accurate, AMD’s shares would rise 35% by the end of fiscal 2024, outperforming the S&P 500’s increase of 20% over the last 12 months.

AMD is on a promising growth path, making its stock a smart buy in the new year.

Leave a Reply