Yahoo Finance’s Chartbook, showing how real wages increase as inflation declines. It explains why this trend is important for the economy and workers.

These charts show us how the market and the economy are doing well and moving forward in 2024, even though there were some problems earlier this year.

But these charts also show us something else: the details that are often missed by both the pessimists and the optimists who talk about the markets. They usually focus on AI and interest rates too much.

These charts help us understand the different forces that affect stocks, wages, prices, and more. And like most things in life, they are not always consistent.

Inflation is going down. Stocks seem to be too expensive compared to history. Most stocks are not doing great. A big increase in productivity could change everything.

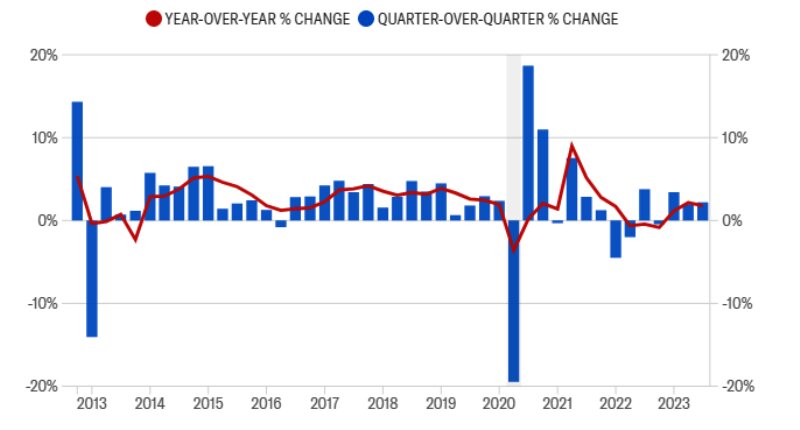

And, as our Chart of the Week reveals, consumers are still buying things, thanks to a rise in their real income after adjusting for inflation.

Neil Dutta, the leader of economic research at Renaissance Macro, said that this common negative idea of a US consumer who is running out of money is not true in the data.

“[Consumers] have used up all their extra savings, and, as a result, they have no more savings to spend,” Dutta wrote, describing the doubtful case against US consumers.

“I don’t agree. The extra saving story is one that has no use anymore.”

“Consumption is being supported by continuous increases in real incomes,” Dutta added. “With consumer price inflation going down, and the labor markets strong, real incomes are going up. Since May, real incomes without [excluding] transfers, a key factor for recession, are up about 3% at a yearly rate.”

And even though these numbers come from a different source, Friday’s jobs report showed that wage increases were still good, going up 0.6% from the previous month in January and 4.5% from last year. And this while inflation keeps going down.

No wonder consumer mood has been so positive — and, this week, even better.

Leave a Reply