Wall Street has seen a lot of ups and downs since 2020. The CBOE Volatility Index, which measures how much the market swings, is at its lowest level in years. But investors have also witnessed the three major stock indexes go from bear to bull markets and back again in the past few years.

When the market gets tough, investors look for businesses that can perform well in any situation. The FAANG stocks are one example of such businesses, but they are not the only ones. Another group of businesses that investors love are the ones that split their stocks.

Stock Split Matter

A stock split is when a company changes its share price and the number of shares it has without changing its market value or how it operates. It is just a cosmetic change that can make a difference for investors.

There are two types of stock splits: forward and reverse. A forward stock split is when a company lowers its share price and increases its number of shares. This can make the stock more affordable and attractive for regular investors. A reverse stock split is when a company raises its share price and reduces its number of shares. This can help the company stay on a major stock exchange by meeting the minimum price requirement.

Investors usually prefer forward stock splits over reverse stock splits. Forward stock splits can signal that a company is doing well and expects to grow more. Reverse stock splits can signal that a company is struggling and needs to boost its share price.

Companies Have Split Their Stocks

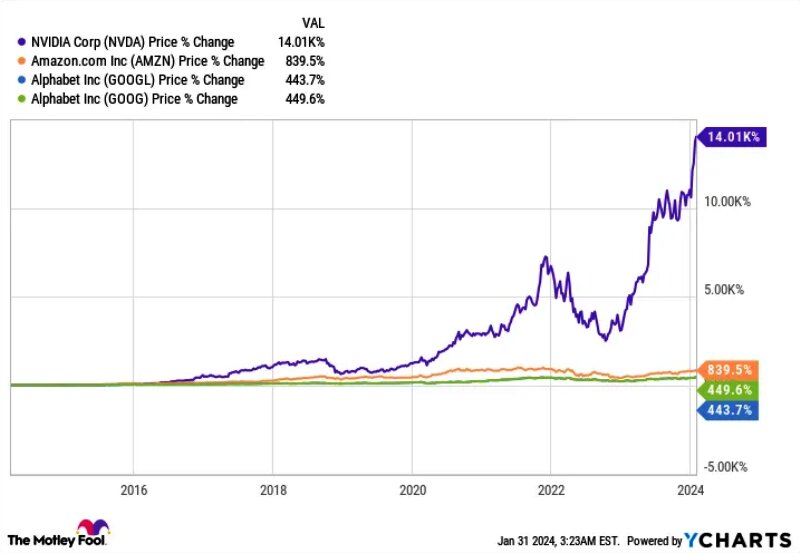

Since mid-2021, nine well-known companies have done forward stock splits. These include Nvidia (NASDAQ: NVDA), Amazon (NASDAQ: AMZN), and Alphabet (NASDAQ: GOOGL)(NASDAQ: GOOG), among others. Nvidia did a 4-for-1 split in 2021, while Amazon and Alphabet did 20-for-1 splits in 2022.

These companies are leaders in their industries and have strong growth prospects. They split their stocks to make them more accessible and appealing to a wider range of investors.

Nvidia is the leader in the artificial intelligence (AI) industry. Its A100 and H100 graphics processing units (GPUs) are used in most of the data centers that run AI applications. Nvidia has a huge advantage over its rivals in this field and is not likely to lose it anytime soon.

Amazon is the leader in the e-commerce industry. It has a 39.5% share of the online retail sales in the U.S. in 2022, according to Insider Intelligence. That is more than eight times the share of its 14 closest competitors combined. Amazon also has the leading cloud-infrastructure service in the world, called Amazon Web Services (AWS).

Alphabet is the leader in the internet search industry. Its Google search engine has a 92% share of the global internet search market in December 2023. It has maintained a 90% or higher share for over eight years. Alphabet also owns YouTube, the second most popular social site in the world, and Google Cloud, the third largest cloud-infrastructure service in the world.

These companies have shown that stock-splitting is a smart move for them and their investors. They have increased their market share, revenue, and profits by offering high-quality products and services that are in high demand. They have also made their stocks more affordable and attractive for investors who want to own a piece of their success.

Walmart’s 3-for-1 Stock Split

On Jan. 30, after the market closed, Walmart (NYSE: WMT) announced that it will split its stock 3-for-1 in the coming weeks. The retail giant said that the split was part of its “ongoing review of optimal trading and spread levels.” Walmart’s CEO and president, Doug McMillon, explained that the split was aimed at making it easier for its employees to buy whole shares of the company’s stock. He said, “Sam Walton believed it was important to keep our share price in a range where purchasing whole shares, rather than fractions, was accessible to all of our associates. Given our growth and our plans for the future, we felt it was a good time to split the stock and encourage our associates to participate in the years to come.”

The stock split will have an interesting effect on Walmart’s role in the Dow Jones Industrial Average. The Dow is an index that weighs stocks by their share prices. Walmart’s share price will drop from about $165 to about $55 when the market opens on Feb. 26, 2024. This means that Walmart will have less influence on the Dow’s movements. Walmart is currently the 17th most influential stock in the Dow, but it could be among the bottom five after the split.

However, this is a small trade-off for Walmart’s long-term success.

One of the reasons Walmart has been so successful is its massive size. It has the resources and the variety to offer lower prices than smaller or local competitors. It also has the appeal to attract customers who want to save money. If inflation rates remain high, Walmart will benefit from this advantage.

Another reason Walmart has been outperforming for decades is its innovation and adaptation. Last year, Walmart announced plans to increase the use of automation and data in its supply chain. This will help it improve its inventory management, its online and offline sales, and its ability to respond to changing customer needs. By the end of fiscal year 2026 (Jan. 31, 2026), Walmart expects that about 55% of its fulfillment-center volume will be handled by automated facilities.

Walmart’s investments in technology will also help it maintain its competitive edge. It will be able to lower its costs and pay higher wages to its workers who are making a difference on the front lines.

However, Walmart is not cheap by any measure. It is trading at a forward P/E ratio of over 25, which is the highest it has been in at least 10 years. Even with its strong competitive advantages, Walmart will need more than a stock split to boost its valuation.

Broadcom Could Be the Next Stock to Split After Walmart

Walmart (NYSE: WMT) recently announced a 3-for-1 stock split, making it the first major company to do so in 2024. This could spark a trend among other high-priced stocks to follow suit and make their shares more affordable for average investors. One such stock that could be next in line is Broadcom (NASDAQ: AVGO), the semiconductor powerhouse.

Broadcom has a history of splitting its stock before it was acquired by Avago in 2016. Since then, the company has not split its stock, even as its share price soared more than 2,100% in the past 10 years to over $1,200 per share. This could be a good time for Broadcom to split its stock and attract more investors to its growing business.

Broadcom’s main strength is its wireless segment, which makes chips and components for next-generation smartphones. The company has benefited from the 5G upgrade cycle, which has boosted the demand for its products. Broadcom’s operating cash flow has increased steadily as a result.

Broadcom also has a huge backlog of orders, which gives it visibility and stability in its revenue. In 2023, CEO Hock Tan revealed that the company had $31 billion worth of orders in its backlog as of September 2022. This shows that Broadcom has a strong competitive position and customer loyalty in the semiconductor industry.

But the biggest catalyst for Broadcom’s stock in the past year has been its AI (artificial intelligence) chip, the Jericho3-AI. This chip can connect up to 32,000 GPUs (graphics processing units) in high-performance data centers. This gives Broadcom an edge in the fast-growing AI market, where speed and efficiency are crucial.

Broadcom is expected to report its fiscal first-quarter results in about a month. It won’t be surprising if the company announces a stock split along with its earnings. Broadcom could be the second big-name stock to split in 2024 after Walmart.

Is Walmart a good investment right now?

Before you buy Walmart stock, consider this:

The Motley Fool Stock Advisor team has just revealed what they think are the 10 best stocks to buy right now and Walmart is not one of them. The 10 stocks they picked could deliver huge returns in the next few years.

Stock Advisor gives investors a simple and effective plan for success, including advice on building a portfolio, regular updates from analysts, and two new stock picks every month. The Stock Advisor service has outperformed the S&P 500 by more than three times since 2002*.